Introduction: Why Accounting Services Matter in 2025

The year 2025 marks a significant shift in Vietnam’s tax and accounting system. Two notable regulatory changes include the mandatory use of electronic invoices generated from point-of-sale (POS) systems for businesses selling directly to retail customers starting June 1, 2025, and the reduction of VAT (Value-Added Tax) to 8% beginning July 1, 2025. These are just two among a series of new legal policies requiring businesses to adapt quickly.

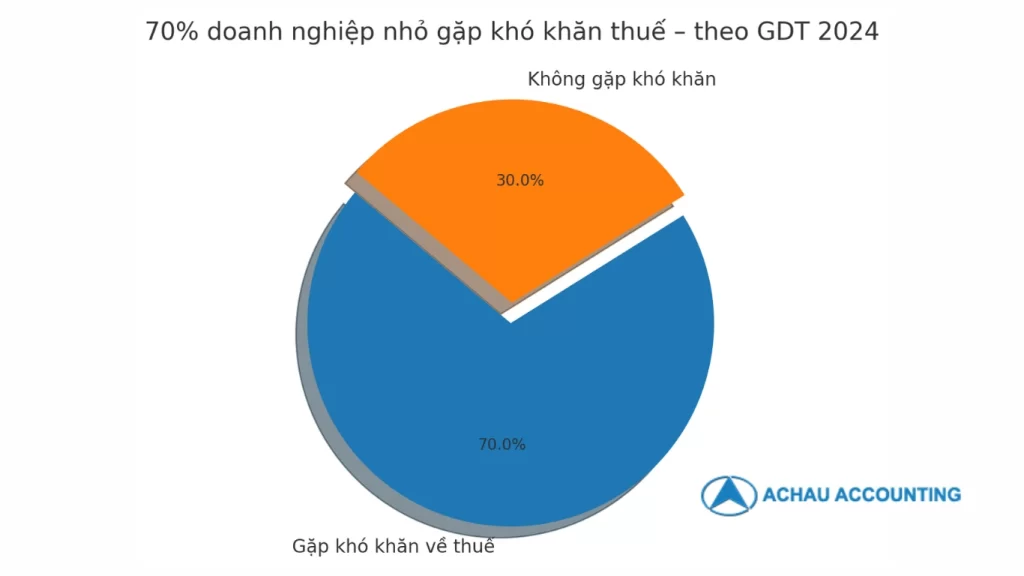

According to the General Department of Taxation (2024), over 70% of small businesses in Vietnam struggle with tax compliance due to a lack of expertise, resulting in fines totaling VND trillions each year. In this context, professional accounting services have moved beyond simple bookkeeping—they are now a strategic function that empowers business growth, minimizes legal risks, and helps optimize financial operations.

In Vietnam and across the globe, accounting service providers play a pivotal role in ensuring that businesses, especially SMEs, can focus on core operations while remaining compliant with local tax and financial laws.

What Is an Accounting Service?

An accounting service is a professional offering—either internal or external—that manages a business’s financial operations, compliance obligations, and fiscal reporting. In essence, it ensures that an enterprise’s financial activities are accurately recorded, analyzed, and reported according to the relevant laws and regulations. Accounting services are essential for maintaining financial health, enabling transparency, and supporting business growth.

These services encompass a broad spectrum of tasks such as bookkeeping, tax filing, payroll management, financial forecasting, budget analysis, and audit preparation. A competent accounting service not only manages day-to-day financial records but also helps business owners make strategic decisions based on reliable data. Whether through a dedicated in-house department or outsourced providers, the role of accounting services has evolved into a critical pillar of corporate governance, especially in the rapidly shifting economic and regulatory landscape of 2025.

By employing the right accounting service, businesses can ensure timely compliance, avoid legal penalties, streamline internal processes, and focus on their core operations. For small and medium-sized enterprises (SMEs) in particular, choosing a reliable and knowledgeable accounting partner is a key strategic advantage.

Types of Accounting Services in 2025

As financial regulations and tax laws continue to evolve in 2025, choosing the right type of accounting service is essential for businesses aiming to stay compliant, control costs, and streamline operations. Below are the three primary types of accounting services available, each catering to different business models and growth stages.

In-House Accounting

Overview:

In-house accounting refers to a fully staffed internal department within a company responsible for managing all financial tasks, including bookkeeping, tax filing, payroll, and financial reporting. These employees are hired, trained, and managed directly by the business.

Advantages:

- Direct control over financial operations: Businesses maintain full oversight of accounting tasks and financial records.

- Company-specific expertise: In-house accountants gain deep insights into the business’s internal processes, goals, and financial strategies.

- Enhanced confidentiality: Sensitive financial data stays within the organization, reducing the risk of leaks.

Disadvantages:

- High operational costs: Salaries, insurance, employee benefits, and ongoing training can be expensive.

- Skill limitations: The business may rely on a small team that might lack knowledge in specialized areas like international tax or digital transformation in finance.

Ideal for: Large corporations or enterprises with complex financial systems and the resources to maintain a dedicated accounting department.

Outsourced Accounting Services

Overview:

This model involves contracting a third-party accounting firm to handle part or all of a company’s accounting tasks. Services range from monthly bookkeeping to full-scale financial management, tax planning, and compliance.

Advantages:

- Cost savings: Eliminates the need to hire full-time staff and reduces overhead.

- Access to expertise: Outsourced firms employ skilled professionals well-versed in evolving regulations.

- Scalability: Businesses can easily adjust service packages based on their current needs.

- Technology-driven: Most firms offer cloud-based systems for real-time financial visibility.

Disadvantages:

- Limited control: Day-to-day oversight may be less direct compared to an in-house team.

- Data privacy concerns: Businesses must choose reputable providers to ensure data protection.

Ideal for: Startups, small and medium-sized enterprises (SMEs), and growing companies seeking flexible and affordable solutions.

Part-Time or Consulting Accountants

Overview:

These are independent professionals hired on a temporary, part-time, or project-specific basis to perform specialized tasks such as financial audits, tax consulting, or system setup.

Advantages:

- Affordable and flexible: Businesses pay only for the time and expertise they need.

- Specialized knowledge: Consultants often bring industry-specific or technical expertise.

Disadvantages:

- Inconsistent availability: Part-time professionals may not always be available when urgent issues arise.

- Limited scope: They may not provide continuous, holistic accounting support.

Ideal for: Freelancers, micro-businesses, and seasonal companies with limited and irregular accounting needs.

Related post: Top 10 best financial advisory company of 2024

Benefits of Accounting Services

In today’s fast-changing business environment, relying on professional accounting services offers more than just number crunching. Whether you’re managing a growing startup or running an established business, here’s why partnering with a trusted accounting provider in 2025 can give you a serious competitive edge:

Ensure Legal Compliance

With regulatory frameworks shifting rapidly—such as Vietnam’s mandatory e-invoicing (effective June 2025), evolving VAT rules across ASEAN, and tax policy changes in Europe—businesses must stay compliant or risk serious consequences. A professional accounting service monitors these changes and ensures your financial operations align with local and international regulations. This helps you avoid fines, audits, and legal complications.

Cost Efficiency

Hiring, training, and maintaining a full in-house accounting team can be expensive. Outsourcing removes the burden of overhead costs like salaries, benefits, and office space. It also helps reduce costly errors, such as late tax filings or incorrect reports, which can lead to penalties or missed financial opportunities.

Strategic Financial Planning

Beyond compliance, expert accountants provide valuable insights for long-term growth. They help you:

- Track cash flow and profitability

- Forecast growth scenarios

- Evaluate financial health

These insights enable smarter, data-driven decisions that support business scalability and resilience.

Improved Data Accuracy & Timeliness

Reliable accounting services ensure that your financial data is consistently accurate and delivered on time. This is especially important during audits, investor due diligence, or when filing taxes. Precision in your books builds trust with stakeholders and protects your reputation.

Focus on Core Business

By delegating financial tasks to specialists, you and your team can focus on what truly matters—growing your business. From product innovation to customer experience, your energy stays directed at strategic areas instead of getting lost in spreadsheets and tax deadlines.

How to Choose the Right Accounting Service in 2025

Choosing the right accounting service in 2025 is more important than ever. In the face of increasingly strict compliance requirements, mandatory electronic invoicing, and rapid digitalization, a suitable accounting partner should not only handle your financials but also act as a strategic advisor.

Define Your Needs

Start by understanding the scale and nature of your business:

- For small businesses and SMEs: Consider full-service or outsourced accounting solutions that can manage bookkeeping, tax filing, payroll, and reporting without requiring a full in-house team.

- For startups: Look for tax-focused accounting support to manage VAT returns, invoice issuance, and financial filings as your business grows. Knowing exactly what you need helps in finding a provider who offers both compliance and consulting services.

Evaluate Credibility and Experience

Assess the provider’s background before signing any agreement:

- Check for legal business licenses and relevant certifications

- Ask for proof of industry-specific experience or client references

- Look for public client reviews on Google My Business, Facebook, or forums related to finance and taxation

Technology and Security Standards

In 2025, a tech-driven approach is non-negotiable:

- Ensure the firm provides a cloud-based platform with 24/7 access to invoices, reports, and audit logs

- Data encryption, regular backups, and firewall security are must-haves to protect sensitive financial data

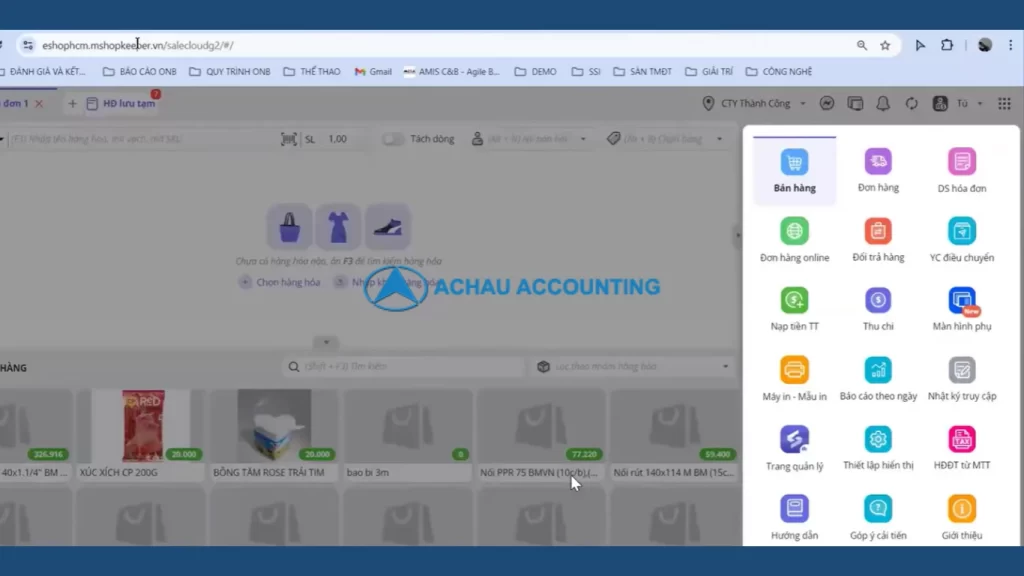

- Some firms, such as A Chau, also offer complimentary software for clients

Transparent Pricing and Contract Flexibility

Choose firms with clear pricing structures:

- Standard monthly packages in Vietnam range from VND 500,000

- Ensure contracts are adaptable to your company’s growth stage

- Look for Service Level Agreements (SLAs) or guarantees on turnaround times and quality

Prefer Local Support for Practicality

Having a local office matters for ease of communication:

- If your operations are in Ho Chi Minh City, prioritize firms like A Chau with accessible offices for in-person meetings

- Local teams understand regional compliance nuances better and offer faster support during tax audits or deadline rushes

Related post: 101 Why Choosing an Accounting Services Company in Vietnam!

Challenges and Solutions in 2025

Common Challenges

In 2025, many businesses—especially small and medium-sized enterprises—face substantial obstacles in adapting to the new financial and tax environment:

- Limited Financial Resources: A significant number of small businesses lack the budget to implement digital invoicing systems or purchase modern accounting software.

- Skill Gaps: Internal staff may lack the necessary training or technical skills, leading to delays or errors in tax filing, invoice issuance, and year-end settlements.

- Time Constraints: With new deadlines imposed by legal reforms, businesses without a dedicated finance department often struggle to meet compliance requirements in time.

- Information Overload: With numerous updates in tax laws, keeping up with all regulatory changes becomes overwhelming for non-specialists.

Practical Solutions

To navigate these challenges, businesses can adopt several actionable strategies:

- Engage a Trusted Accounting Partner: Firms like A Chau provide free consultations and offer tiered service packages suited to all business sizes. Their hotline (09199.111.84) is available for immediate support.

- Pursue Tax Training Programs: Enroll in certified courses offered by the General Department of Taxation via www.gdt.gov.vn to stay updated and avoid compliance mistakes.

- Leverage Integrated Technology: Adopt cloud-based accounting systems that bundle invoicing, tax filing, and reporting in one place. These tools reduce human error, improve accuracy, and are essential for meeting e-invoicing mandates.

- Plan Ahead for Compliance: Create internal calendars and task lists aligned with government deadlines (e.g., e-invoicing from June 1, 2025; VAT changes from July 1, 2025).

Accounting services in 2025 are no longer limited to number crunching—they play a pivotal role in driving business success through enhanced compliance, efficiency, and adaptability. Amid sweeping changes in Vietnam’s tax regulations, e-invoicing requirements, and digital transformation efforts, choosing the right accounting provider is not just a tactical decision but a long-term investment.

A reliable accounting partner can help your business minimize tax risks, improve cash flow management, and provide clarity in financial planning. Whether you’re a small startup, a growing SME, or a large enterprise, investing in professional accounting support ensures that your operations remain compliant, agile, and scalable in a fast-evolving economy.

Ready to take control of your business finances in 2025?

When choosing our services, clients can be assured of both the quality and the value that the company brings.

A Chau Accounting – Financial Services Company: Your Trusted Partner in Vietnam

Contact for free consultant:

- 0776 112 333 – 0932 154 266

- info@dichvuketoanachau.com

- 643 Dien Bien Phu, Ban Co Ward, Ho Chi Minh City

- Monday – Friday: 8:00 to 17:30

- Fanpage: www.facebook.com/congtyketoanachau